CVS Health recently announced two new pricing models launching in 2025—CVS CostVantage (Focused on CVS as the Provider) and CVS Caremark TrueCost (Focused on CVS as the Payer)—which are intended to “drive aligned incentives and deliver a more transparent and sustainable reimbursement model” according to CVS Health’s press release. Now whether these cost-plus models will spark an industry-wide shift to more simplistic prescription drug pricing is largely unknown at this time. Here is what we do know…

What is CVS CostVantage?

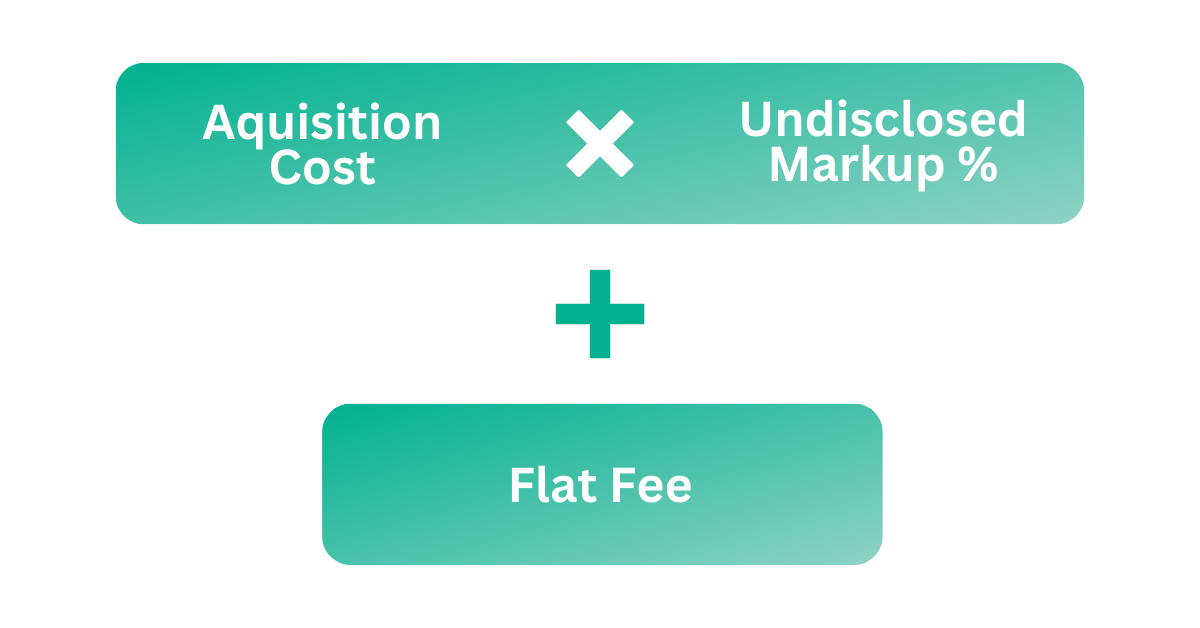

CVS CostVantage, is a simplified reimbursement model that determines drug costs, for both generic and brand-name drugs, through a formula involving the drug’s actual cost, a markup (which will vary from payer to payer), and a fee for pharmacy services.

This initiative will shift how CVS retail pharmacies are compensated by eventually requiring all payers and PBMs contracted with CVS retail pharmacies to reimburse the pharmacy chain accordingly.

How will CVS’s CostVantage impact the industry?

CVS Costvantage won’t directly impact independent pharmacies’ drug pricing or reimbursements, as this initiative focuses on CVS retail pharmacies as a provider. However, according to Adam J. Fein, Ph.D., CEO of Drug Channels Institute “Other large pharmacies will likely follow CVS with attempts to force payers and PBMs to accept some form of cost-plus reimbursement.” While the ripple effects of this are mere speculations at this time, it’s worth keeping tabs on future developments.

What is CVS Caremark TrueCost?

Caremark TrueCost is another dimension of CVS’s pricing strategy, specifically focused on its pharmacy benefits management (PBM) services. According to the 2023 CVS Health Investor meeting Caremark TrueCost will emphasize simplified cost-based pricing that reflects actual net drug costs and will provide transparency to administrative fees and client mark-ups. However, the mark-up percentage will not be consistent as CVS says this rate will be determined based on individual network negotiation.

How will CVS Caremark TrueCost impact the industry?

There are still many questions surrounding the CVS CaremarkTrueCost model, but the initiative is positioned to bring contractual arrangements between network pharmacies and CVS’s PBM services. Following future developments and evaluating the implications of participating in CVS Caremark’s network under the TrueCost model in the future will be critical as more details become available.

The Evolution of the Cost-Plus Prescription Drug Landscape

They might have caused the most buzz, but CVS Caremark is not the first of “The big three” Pharmacy Benefit Managers (PBMs) to announce a cost-based reimbursement model as Express Scripts ClearNetwork was announced just this past November.

There are also many cost-plus independent pharmacies and other major industry players that have already implemented cost-based prescription drug pricing such as Mark Cuban’s Cost Plus Drug Company, and Amazon RxPass.This past summer, Blue Cross Blue Shield of California, declared its decision to drop Caremark as its pharmacy benefit manager (which may have sparked these initiatives from CVS Health). Instead, the insurer opted to collaborate with Mark Cuban Cost Plus Drug Company, Amazon Pharmacy, and other companies to handle their supply chain – essentially creating their own cost-plus PBM.

In certain states, Medicaid programs have also eliminated PBMs and incorporated a pricing model of NADAC plus a dispensing fee. According to the Kentucky Lantern, “[The state’s decision to cut out middlemen] is saving the state money — a lot of money — by putting Medicaid prescription management under a single vendor.”

Collectively these entities and initiatives, coupled with the Federal Trade Commission’s inquiry on PBMs, have brought attention to the complexities of prescription drug pricing. This shift many feel is long overdue and these moves by CVS Health are likely to play a part (more or less) in the continuation of this evolution.

Looking ahead…

In conclusion, as CVS Health (and any other networks that may follow) release more information on the details of their cost-plus pricing models, it’s important to do your due diligence on what the calculation methodologies are being used to determine just what the “cost” and the “plus” of these initiatives entail and be sure that you have a clear understanding of how fees are calculated, the contractual terms, and the potentials implications on your bottom line.